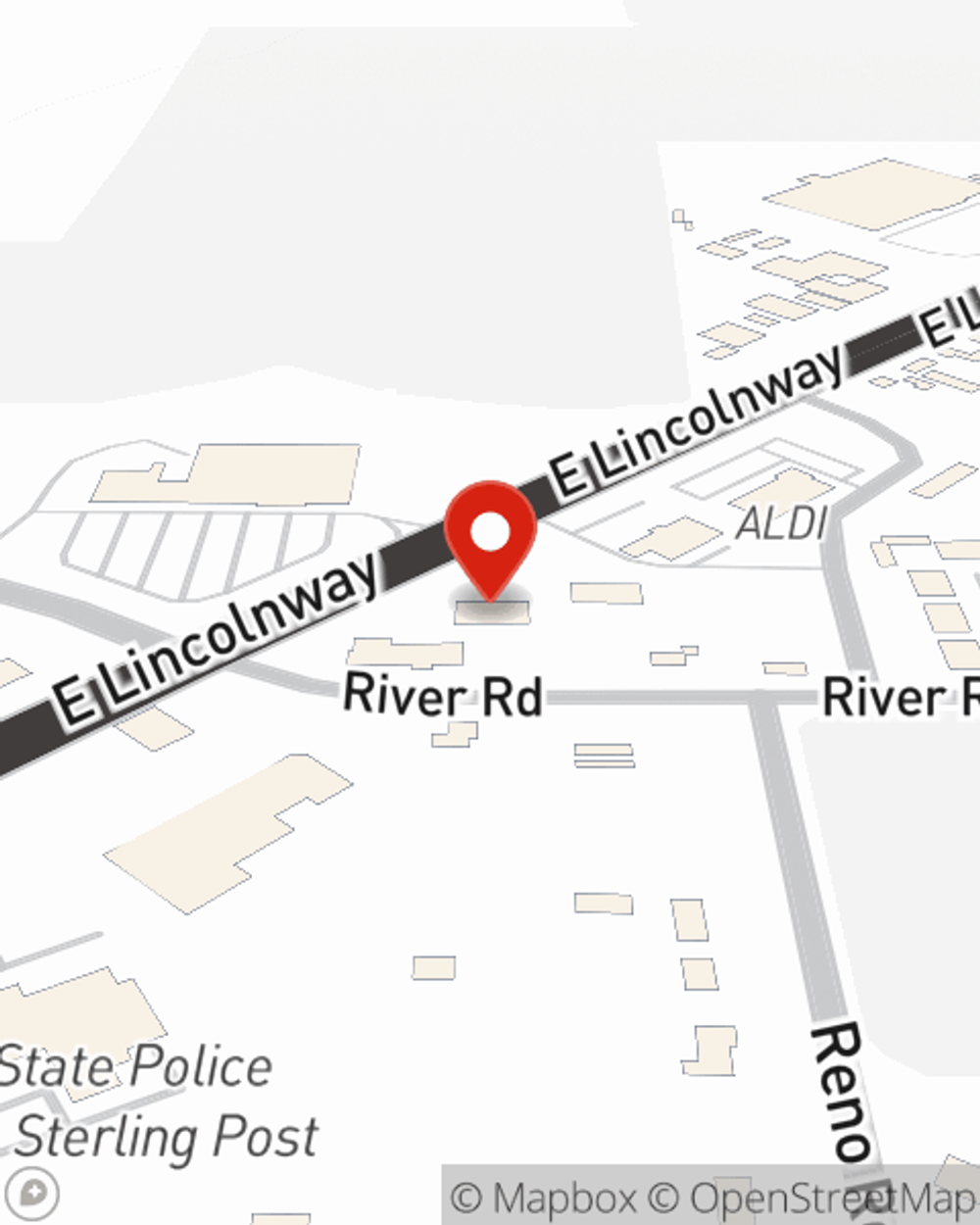

Business Insurance in and around Sterling

Get your Sterling business covered, right here!

Almost 100 years of helping small businesses

- Sterling

- Rock Falls

- Dixon

- Prophetstown

- Erie

- Amboy

- Milledgeville

- Ohio

- Morrison

- Tampico

- Polo

- Walnut

- Franklin Grove

- Ashton

- Lyndon

- Oregon

- Chadwick

- Sublette

- Nelson

- Coleta

- Lanark

- Harmon

- Rochelle

- Byron

State Farm Understands Small Businesses.

As a small business owner, you understand that sometimes the unanticipated does occur. Unfortunately, sometimes accidents like an employee getting injured can happen on your business's property.

Get your Sterling business covered, right here!

Almost 100 years of helping small businesses

Keep Your Business Secure

The unexpected is, well, unexpected, but you shouldn't wait until something happens to make sure you're properly prepared. State Farm has a wide range of coverages, like worker's compensation for your employees or extra liability, that can be formed to develop a customized policy to fit your small business's needs. And when the unexpected does arise, agent Jake Gerdes can also help you file your claim.

Take the next step of preparation and contact State Farm agent Jake Gerdes's team. They're happy to help you explore the options that may be right for you and your small business!

Simple Insights®

Retirement plans for small business owners to consider

Retirement plans for small business owners to consider

Offering a retirement plan, including a SEP IRA, SIMPLE IRA or a 401k, is a great way for a small business to attract and retain employees.

How to hire employees for small business

How to hire employees for small business

Discover helpful strategies on how to hire skilled employees for your small business and learn how to attract and retain the right talent for your growing company.

Jake Gerdes

State Farm® Insurance AgentSimple Insights®

Retirement plans for small business owners to consider

Retirement plans for small business owners to consider

Offering a retirement plan, including a SEP IRA, SIMPLE IRA or a 401k, is a great way for a small business to attract and retain employees.

How to hire employees for small business

How to hire employees for small business

Discover helpful strategies on how to hire skilled employees for your small business and learn how to attract and retain the right talent for your growing company.