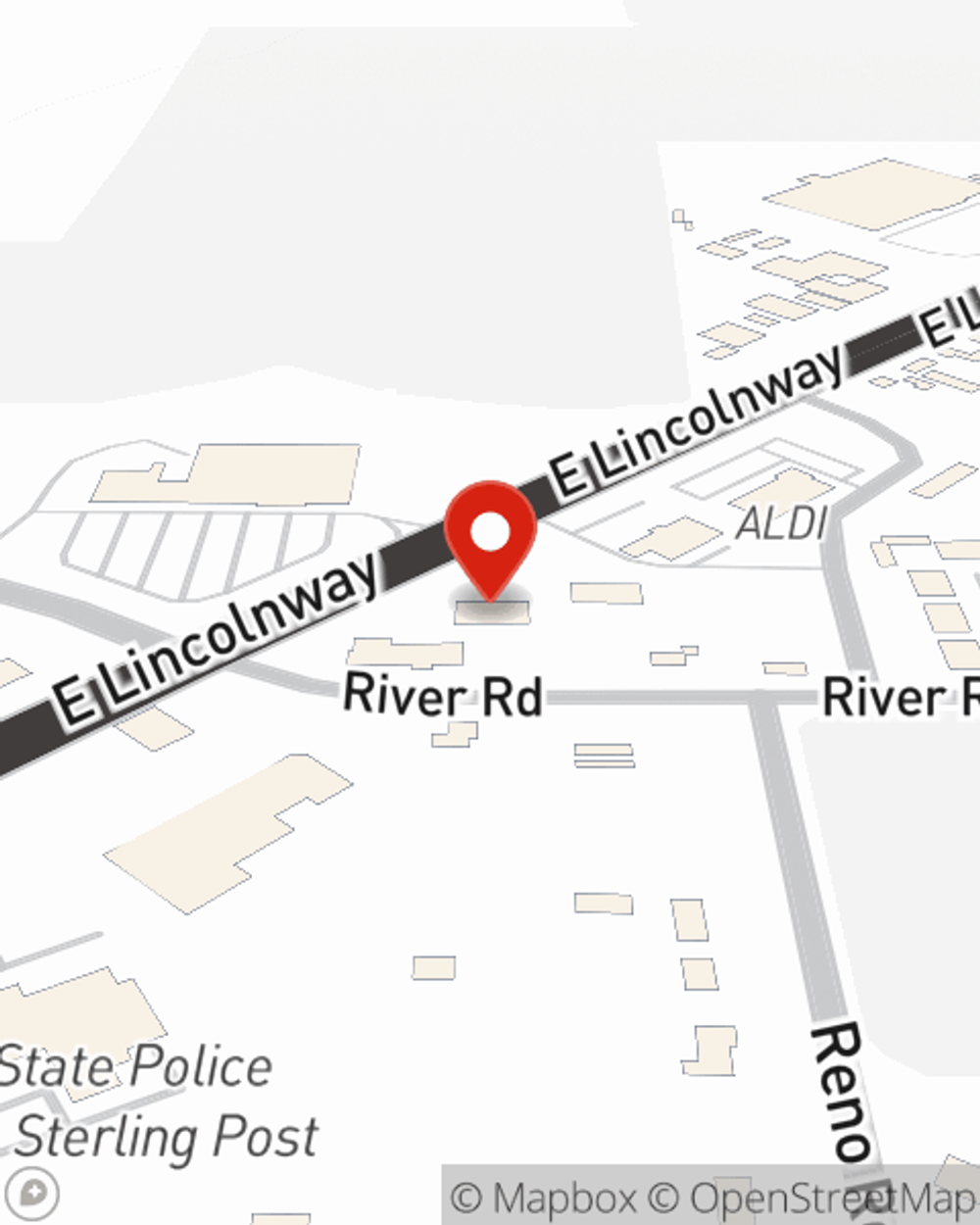

Condo Insurance in and around Sterling

Get your Sterling condo insured right here!

Quality coverage for your condo and belongings inside

- Sterling

- Rock Falls

- Dixon

- Prophetstown

- Erie

- Amboy

- Milledgeville

- Ohio

- Morrison

- Tampico

- Polo

- Walnut

- Franklin Grove

- Ashton

- Lyndon

- Oregon

- Chadwick

- Sublette

- Nelson

- Coleta

- Lanark

- Harmon

- Rochelle

- Byron

Condo Sweet Condo Starts With State Farm

Because your unit is so special to you, it makes sense to want to protect against the unexpected, which could include situations or damage due to vandalism or lightning. That's why State Farm offers coverage options that may be able to help protect your unit and personal property inside.

Get your Sterling condo insured right here!

Quality coverage for your condo and belongings inside

Protect Your Home Sweet Home

No one knows what tomorrow will bring. That’s why it makes good sense to plan for the unexpected with a State Farm Condominium Unitowners policy. Condo unitowners insurance doesn't just protect your condo. It protects both your condo and your valuable possessions. If your condo is affected by a tornado or falling trees, you might have damage to the items inside your condo as well as damage to the townhouse itself. Without insurance to cover your possessions, the cost of replacing your items could fall on you. Some of your belongings can be protected from theft or loss even beyond the walls of your condo. If your bicycle is stolen from work, a condo insurance policy might help you replace it.

If you want to ask any questions, State Farm agent Jake Gerdes is ready to help! Simply visit Jake Gerdes today and say you are interested in this fantastic coverage from one of the top providers of condo unitowners insurance.

Have More Questions About Condo Unitowners Insurance?

Call Jake at (815) 625-5012 or visit our FAQ page.

Simple Insights®

How to throw a safe house party

How to throw a safe house party

Learn tips about hosting a safe party at home, respecting your neighbors when you have parties and minding noise pollution laws.

Pros and cons of buying a condo

Pros and cons of buying a condo

Thinking about buying a condo? Take a look at this list before you make the big decision. It’ll help you weigh the pros and cons of condo living.

Jake Gerdes

State Farm® Insurance AgentSimple Insights®

How to throw a safe house party

How to throw a safe house party

Learn tips about hosting a safe party at home, respecting your neighbors when you have parties and minding noise pollution laws.

Pros and cons of buying a condo

Pros and cons of buying a condo

Thinking about buying a condo? Take a look at this list before you make the big decision. It’ll help you weigh the pros and cons of condo living.